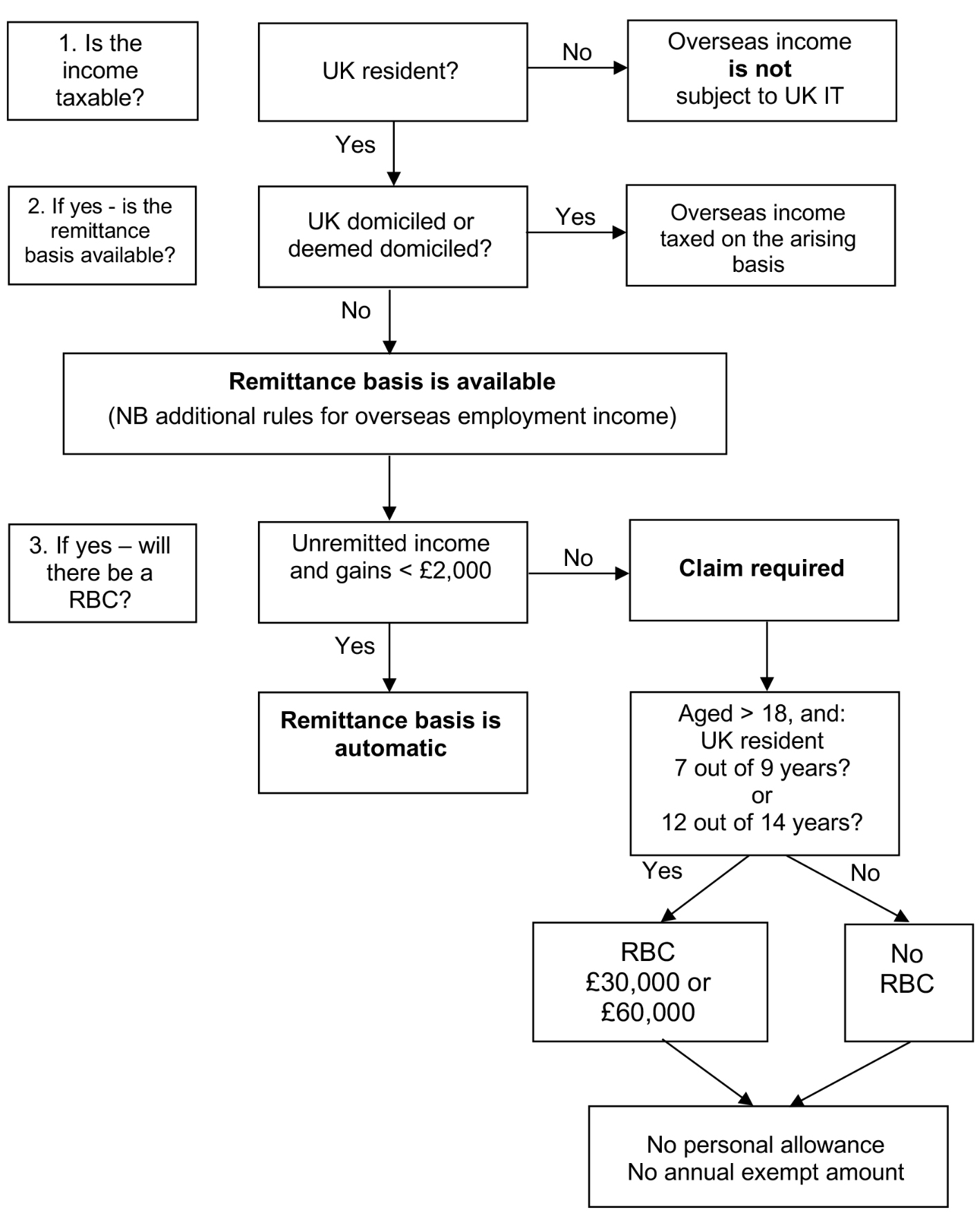

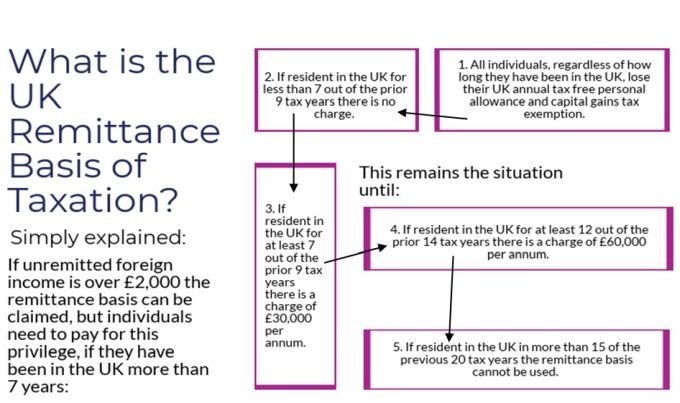

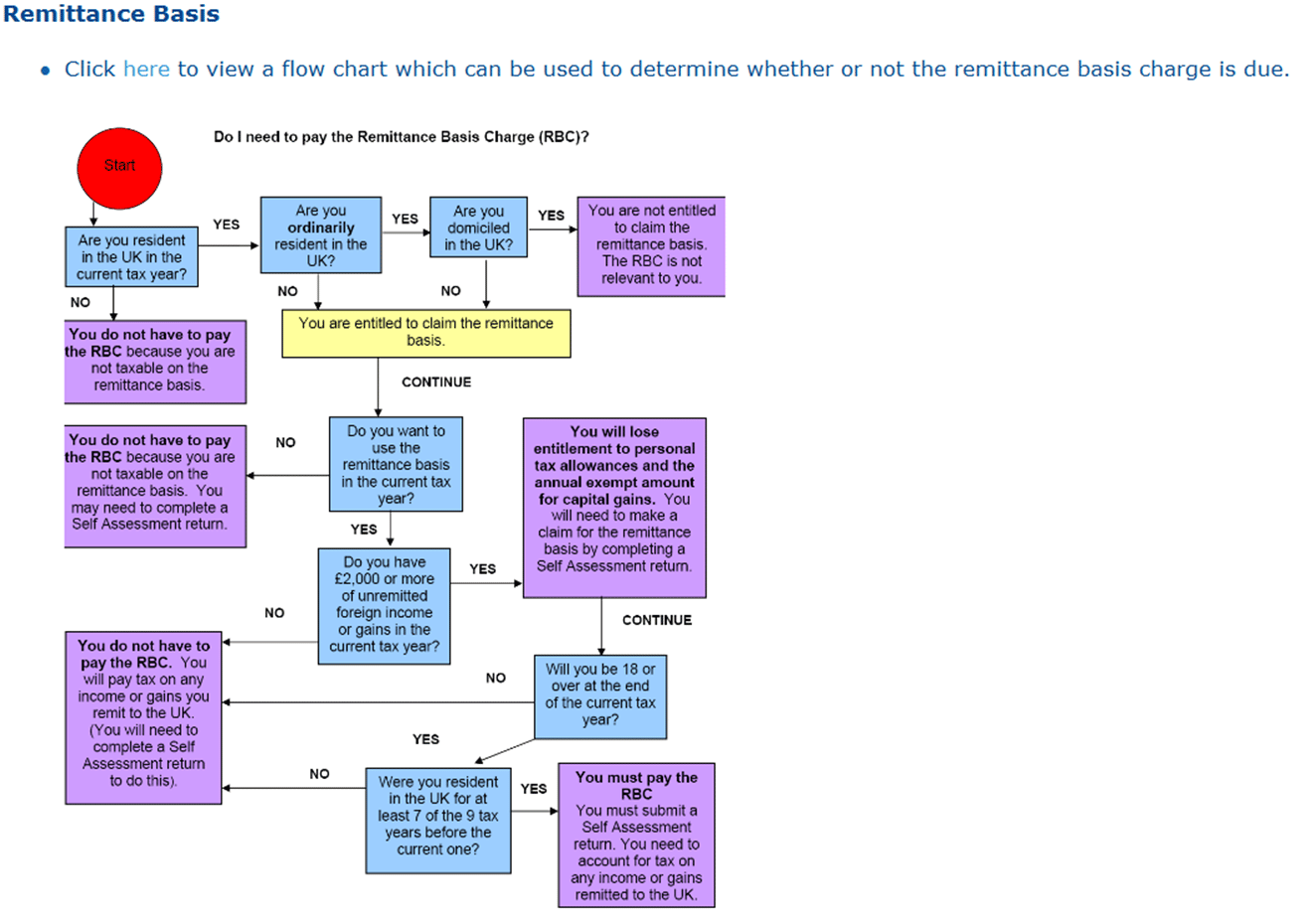

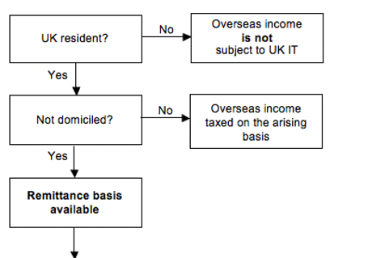

International aspects of personal taxation (for Advanced Taxation - United Kingdom (ATX-UK) (P6)) | ACCA Global

International aspects of personal taxation | P6 Advanced Taxation | ACCA Qualification | Students | ACCA Global

Politax on Twitter: "It really isn't worth 10 seconds of your time. @fullfact or @bbcrealitycheck might want a look though." / Twitter

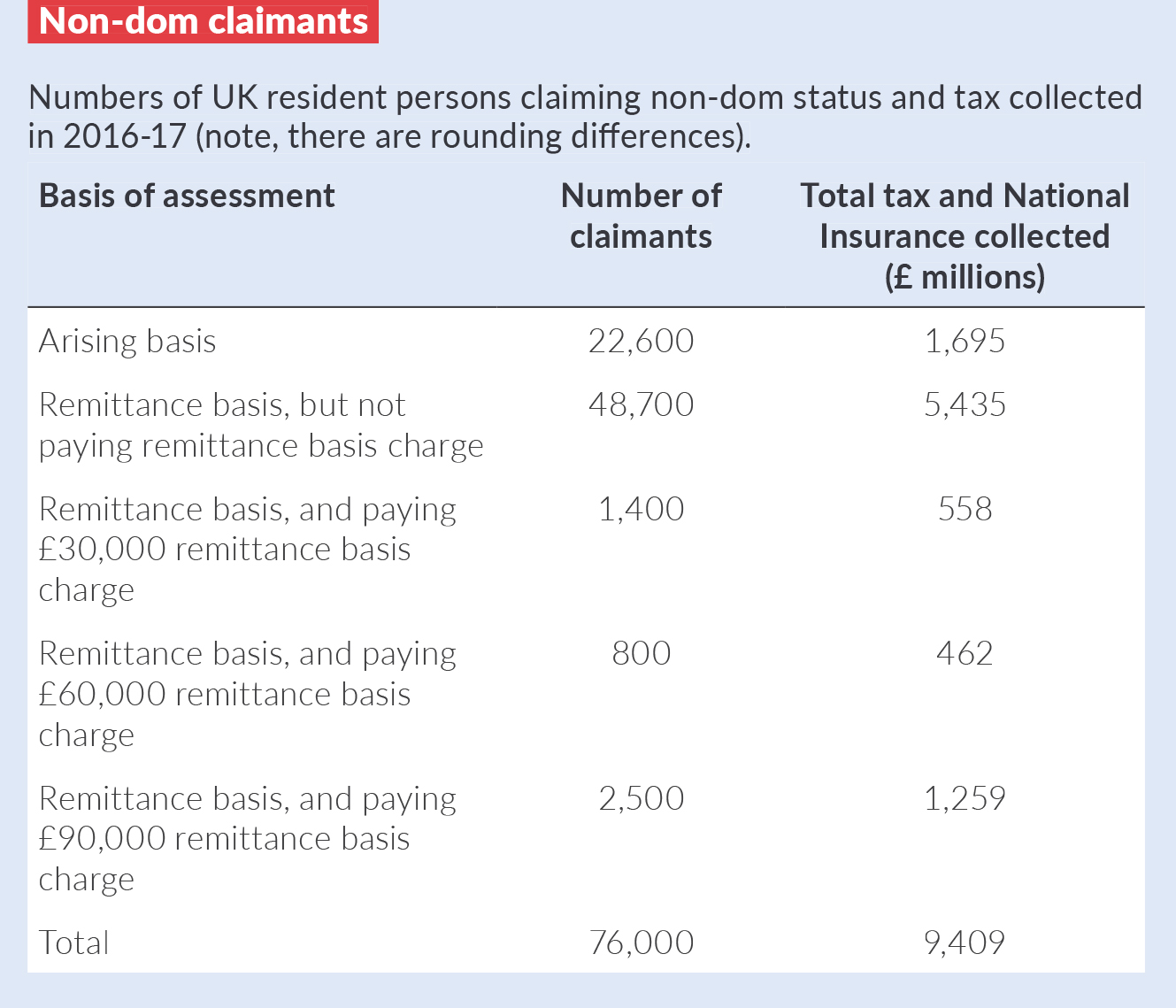

Dan Neidle on Twitter: "How much tax revenue would we raise if we abolished the non-dom rules? A 🧵:" / Twitter

Part I Section 901.—Taxes of Foreign Countries and of Possessions of the United States 26 CFR 1.901-2: Income, War Profits, o

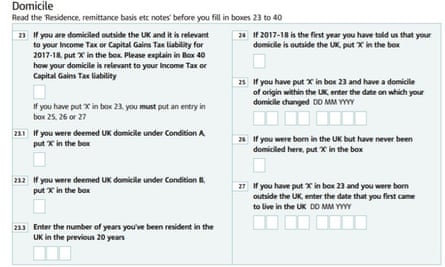

Akshata Murty's non-dom status is a choice not an obligation – tax experts | Tax and spending | The Guardian

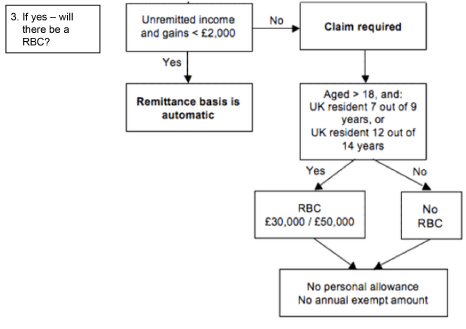

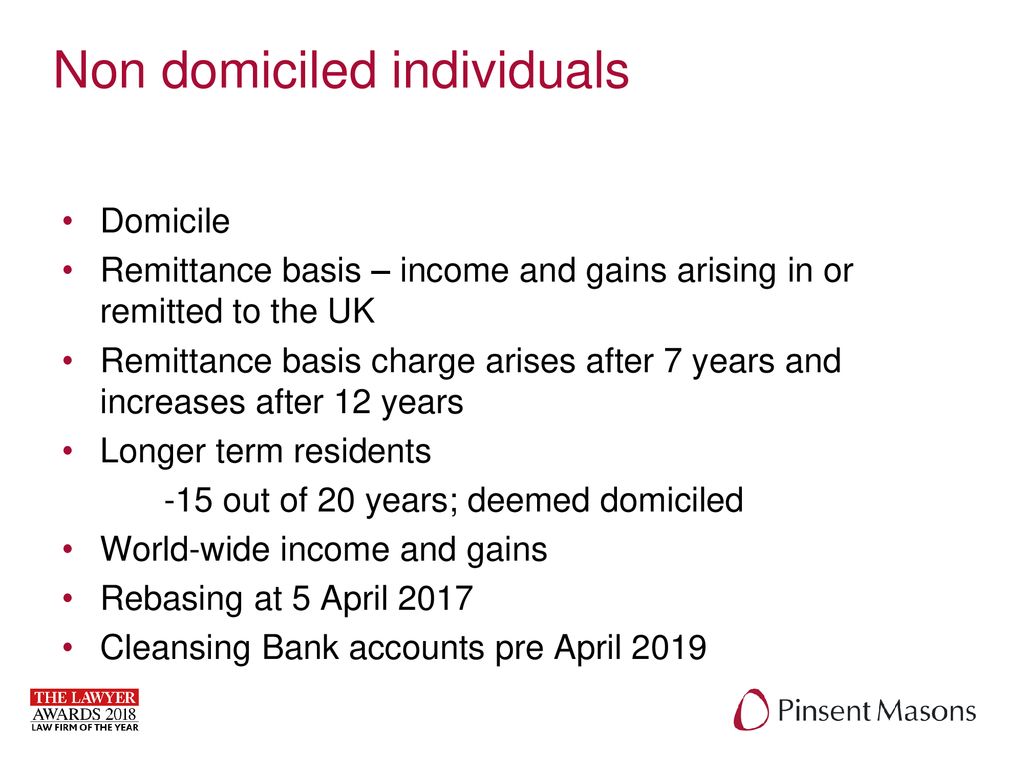

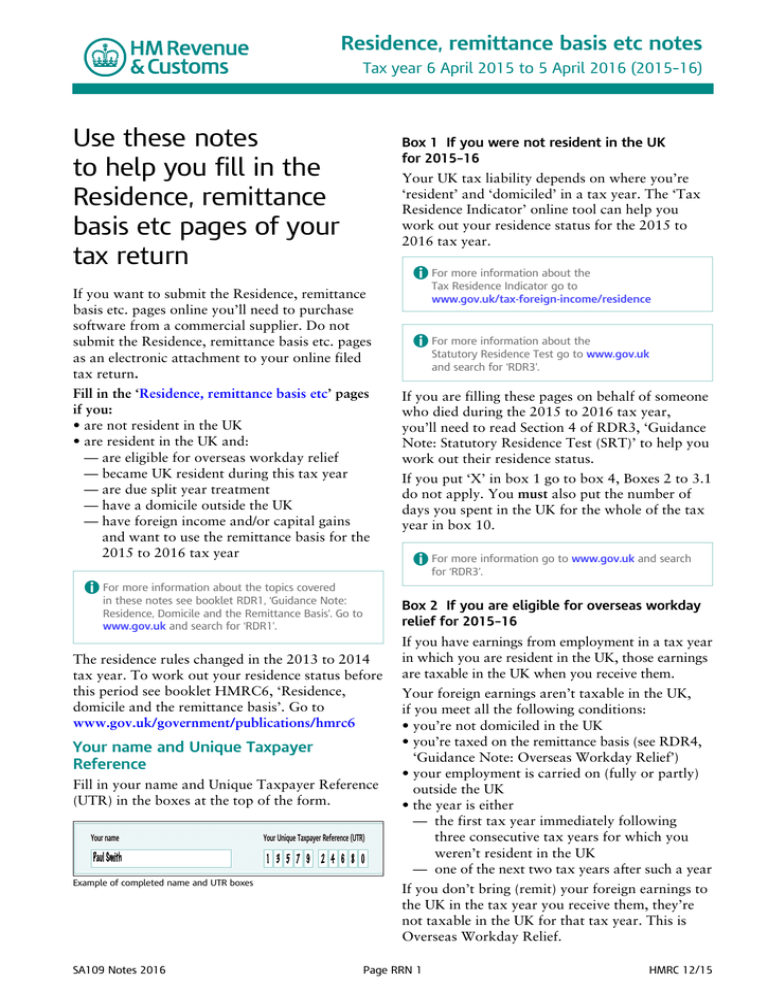

International aspects of personal taxation | P6 Advanced Taxation | ACCA Qualification | Students | ACCA Global