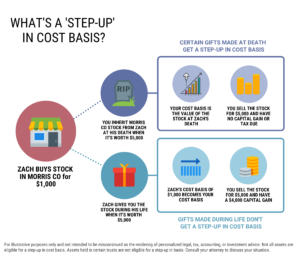

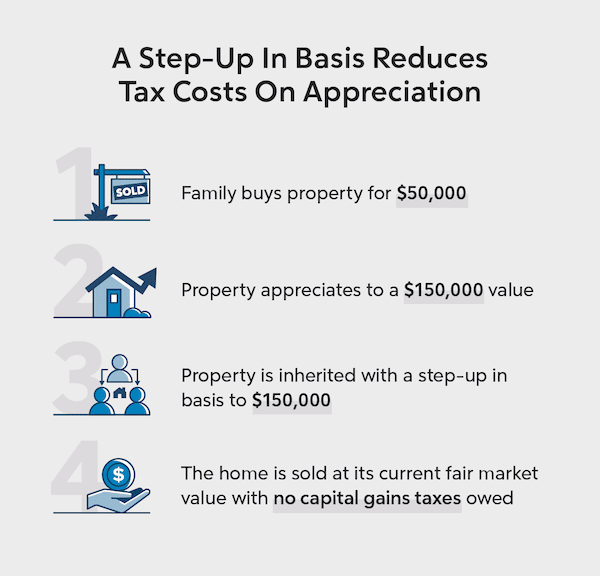

Biden Tax Plan May Leave Estate Tax Alone, But Kill 'Step Up' Provision - Insurance News | InsuranceNewsNet

IRS Issues Revenue Ruling Holding that Assets Held in an Irrevocable Grantor Trust Do Not Receive a Step-Up in Basis at Death | Cole Schotz

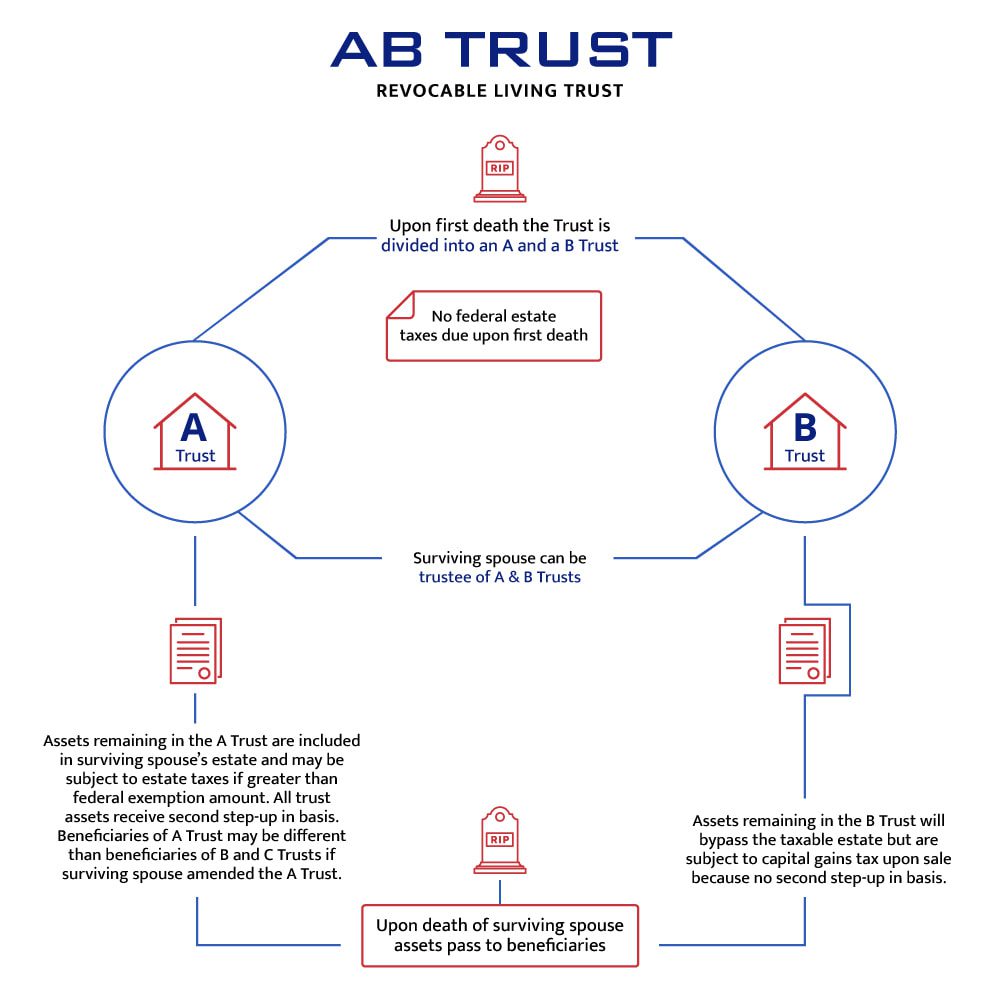

Do Assets in a Living Trust Get a Step-Up in Basis? - Litherland, Kennedy & Associates, APC, Attorneys at Law

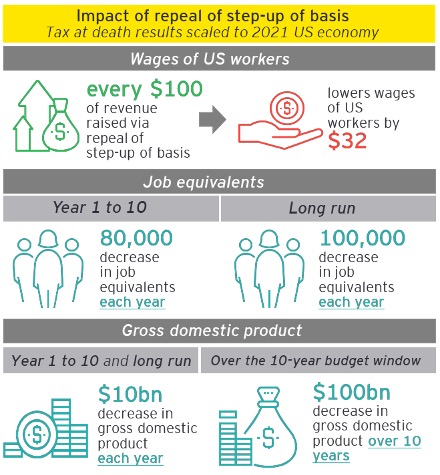

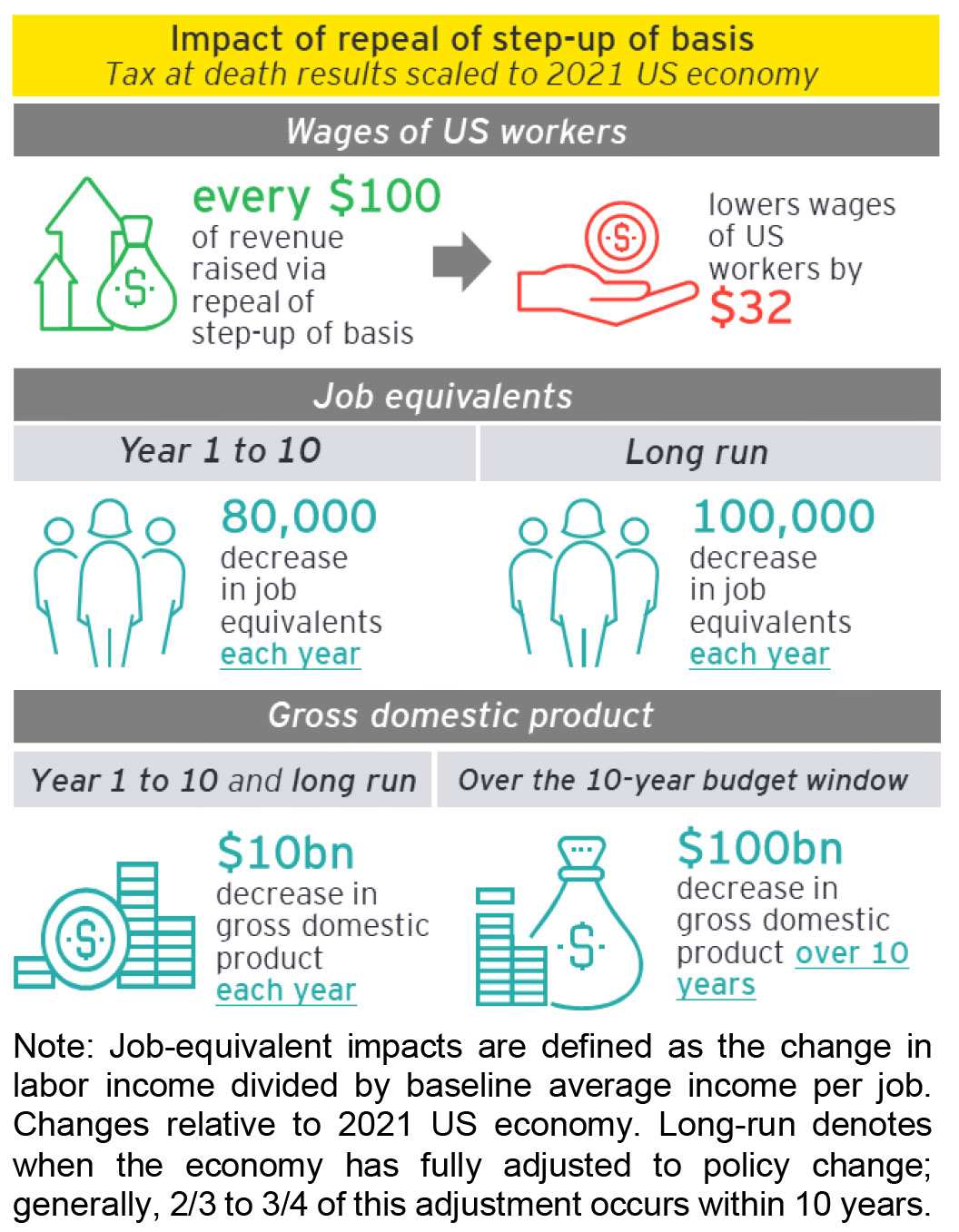

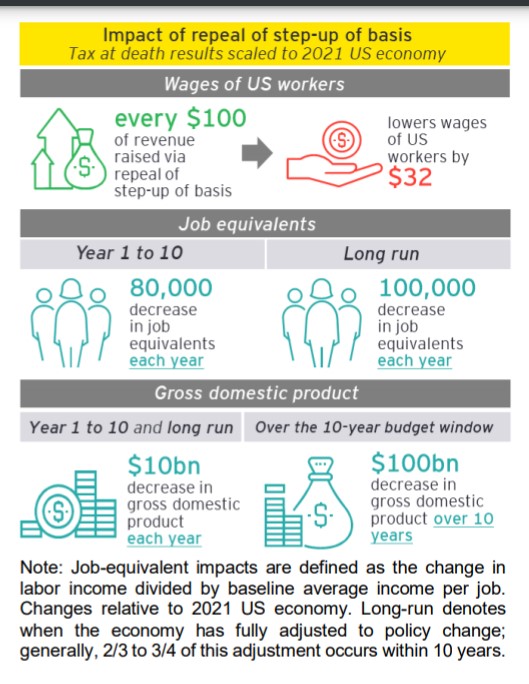

Repealing step-up of basis on inherited assets: Macroeconomic impacts and effects on illustrative family businesses