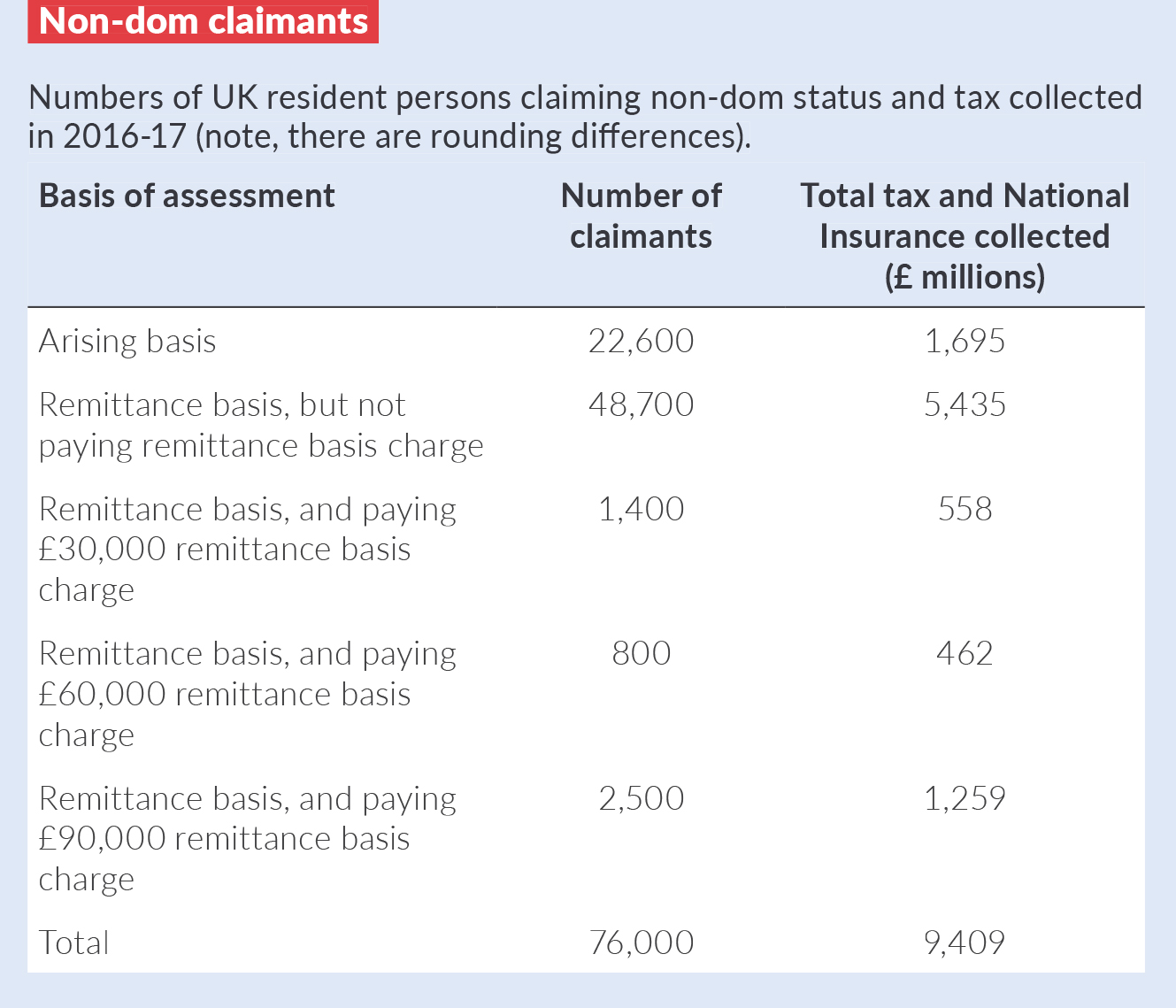

Dan Neidle on Twitter: "Long story short: repealing the non-dom rules and replacing them with something simple, modern, and fair would likely raise several £hundred million in new tax revenue. Possibly much

International aspects of personal taxation | P6 Advanced Taxation | ACCA Qualification | Students | ACCA Global

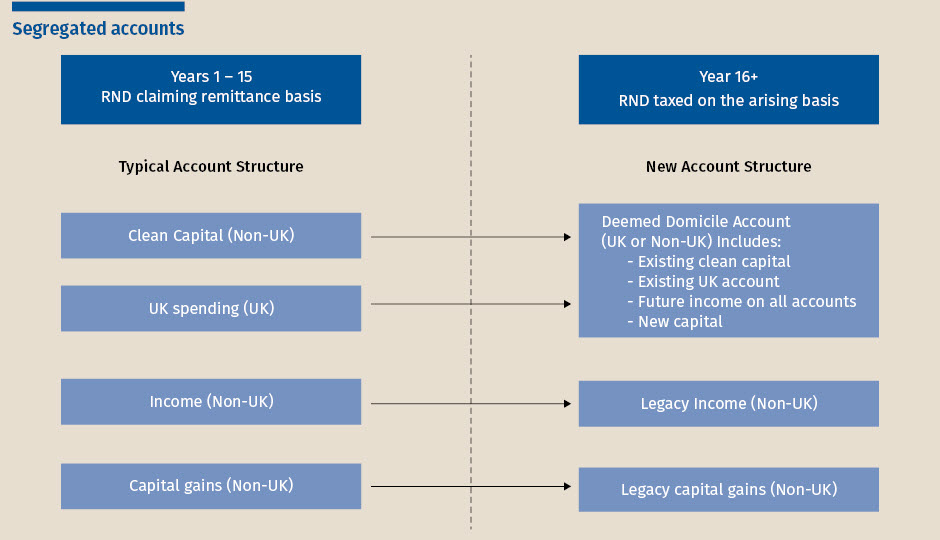

Alex Picot Trust :: The 'protected settlement' – a silver lining to UK resident non-dom tax reforms?