The Basel II Risk Parameters: Estimation, Validation, Stress Testing - with Applications to Loan Risk Management: Engelmann, Bernd, Rauhmeier, Robert: 9783642161131: Amazon.com: Books

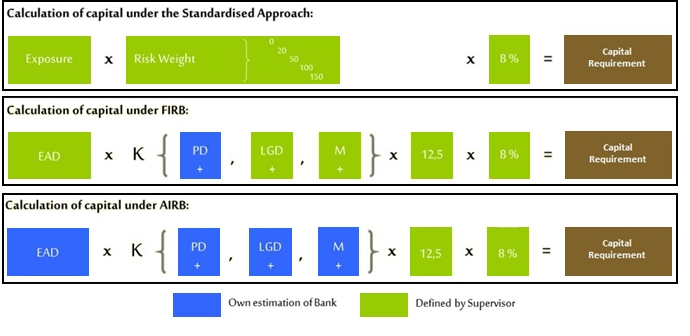

Capital Adequacy - Credit Risk Weights for Internal Ratings Based & Advanced Measurement Approaches - FinanceTrainingCourse.com

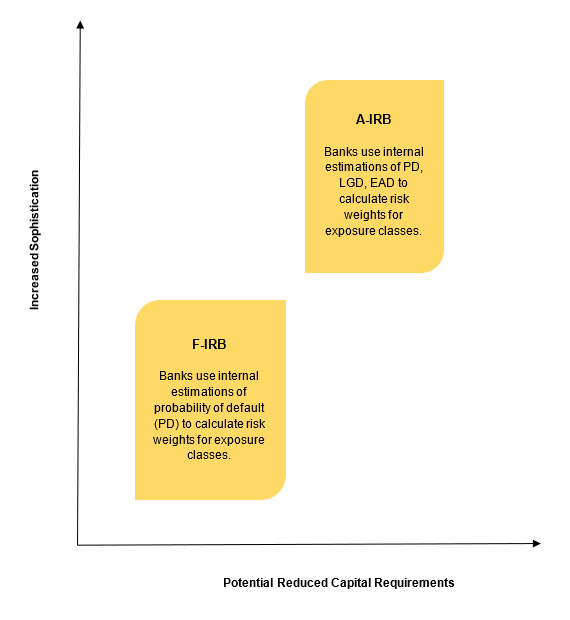

Manoogian Risk Management Consultants - BASEL II IRB APPROACHE: AN OVERVIEW The internal-rating based (IRB) approaches are more sophisticated than the standardized approach, and they require more work and attention. However, on

Capital Adequacy - Credit Risk Weights for Internal Ratings Based & Advanced Measurement Approaches - FinanceTrainingCourse.com

FDIC: FIL-86-2006: Proposed Rule on Risk-Based Capital Standards: Advanced Capital Adequacy Framework